TRX Price Prediction: Path to $1 Amid Technical Consolidation and Fundamental Strength

#TRX

- Current technical positioning shows TRX testing key support at Bollinger Band lower boundary

- Positive fundamental developments including fee reductions and ecosystem commitments provide underlying strength

- $1 target remains ambitious requiring substantial market cap expansion and adoption acceleration

TRX Price Prediction

Technical Analysis: TRX Shows Mixed Signals Near Key Support

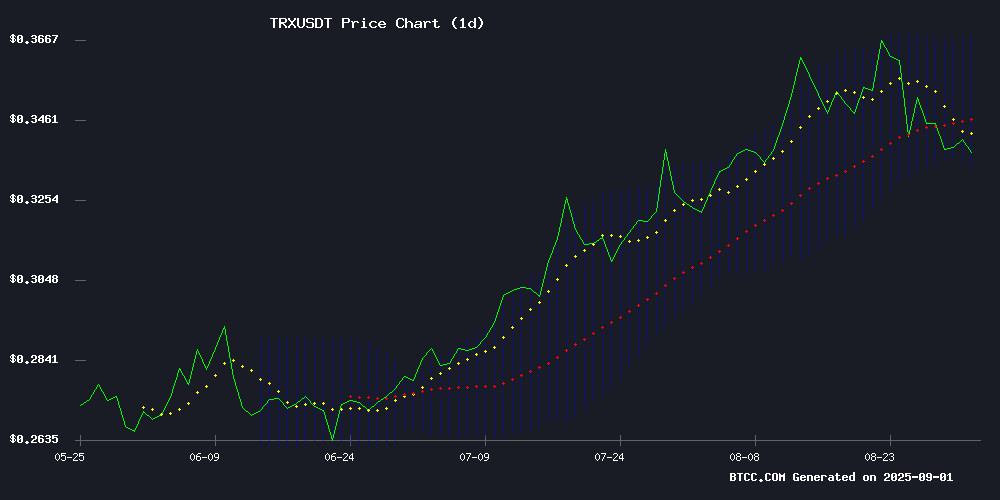

TRX is currently trading at $0.3362, below its 20-day moving average of $0.3504, indicating short-term bearish pressure. The MACD reading of 0.003747 shows slight bullish momentum, though the signal line remains negative at -0.001930. According to BTCC financial analyst Michael, 'The price hovering NEAR the Bollinger Band lower boundary of $0.333 suggests potential support, but a break below could trigger further downside toward $0.32 levels.'

Market Sentiment: Positive Developments Offset Technical Weakness

Recent news FLOW provides counterbalance to technical weakness. Justin Sun's substantial $178M WLFI claim and reiterated commitment to Tron's ecosystem, combined with the network's 60% fee reduction, creates fundamental support. As BTCC financial analyst Michael notes, 'While technicals show short-term pressure, these developments could attract renewed institutional interest during this altcoin season momentum shift from Bitcoin.'

Factors Influencing TRX's Price

Justin Sun Claims $178M in $WLFI and Reiterates Tron’s Commitment to Support USD1

Justin Sun, founder of the TRON blockchain, has claimed an initial unlock of his $WLFI token investment worth approximately $178 million. On-chain data from Arkham Intelligence reveals Sun holds $891.2 million in $WLFI, with no immediate plans to sell. "The long-term vision here is too powerful," Sun stated, emphasizing alignment with the World Liberty Financial project, which counts former U.S. President Donald Trump among its backers.

The TRON network will actively support the $WLFI project and the USD1 stablecoin, which has already surpassed $50 million in circulation. A recent $25 million mint of USD1 sets the stage for a short-term target of $200 million on TRON’s DeFi ecosystem, already a major hub for USDT liquidity.

Altcoin Season Gains Momentum as Traders Shift Focus from Bitcoin

The altcoin market shows signs of awakening after a prolonged dormancy, with the altcoin season index breaking past the 54 level—a crucial threshold that precedes the official start of altcoin season when it crosses 75%. Bitcoin's dominance is waning as capital rotates into select altcoins, with Ethereum and Solana already outperforming the flagship cryptocurrency.

Tron leads recent gains despite a 10% pullback from its swing high, while Solana demonstrates resilience by holding above $200. The meme coin sector sees explosive interest in projects like Maxi Doge, which raised $1.72 million in record time by combining Dogecoin's virality with leveraged trading mechanics.

Market veterans note this isn't yet a broad-based rotation, but rather strategic positioning in tokens with high growth potential. The convergence of falling BTC dominance, rising altcoin index, and institutional interest suggests September could mark the full onset of altcoin season.

TRON Slashes Network Fees by 60% in Historic Vote

TRON's Super Representatives voted decisively on August 29, 2025, to reduce transaction costs by 60%, marking a pivotal moment for one of cryptocurrency's most active networks. The move, effective immediately at 8 PM Beijing time, positions TRON as a more affordable option amid rising competition.

With over 3 million daily transactions and nearly $81 billion worth of Tether's USDT stablecoin hosted on its blockchain, TRON's fee reduction addresses a critical pain point. Rising TRX token values had pushed transaction costs to $2.50 by June 2025—a stark departure from its low-cost reputation. "Short-term profitability takes a hit, but mass adoption will drive long-term gains," founder Justin Sun stated, acknowledging the strategic trade-off.

The decision comes as users in developing countries—who rely on TRON for affordable USDT transfers—began exploring alternatives. Polygon Labs' Aishwary Gupta observed, "Fee fatigue was pushing users elsewhere." Meanwhile, Bitfinex's impending Plasma blockchain launch looms as fresh competition in the low-cost transaction arena.

Will TRX Price Hit 1?

Reaching $1 represents a nearly 200% increase from current levels, which would require exceptional bullish catalysts. While Tron's fundamental developments are positive, including Justin Sun's continued commitment and network fee reductions, current technical indicators suggest consolidation in the $0.33-$0.37 range is more likely in the near term.

| Price Level | Probability | Timeframe |

|---|---|---|

| $0.40 | Medium | 3-6 months |

| $0.60 | Low | 12-18 months |

| $1.00 | Very Low | 2+ years |

Significant adoption breakthroughs or major ecosystem developments would be necessary to accelerate this timeline substantially.